Forgot Password

[job_basic_details]

Quantra algorithmic trading - Quantitative Portfolio Management

Videos + PDFs + Algorithmic trading strategies source codes

------------------------------------------------------https://quantra.quantinsti.com/course/quantitative-portfolio-management

LEVEL

Quantra algorithmic trading - Quantitative Portfolio Management

Videos + PDFs + Algorithmic trading strategies source codes

------------------------------------------------------https://quantra.quantinsti.com/course/quantitative-portfolio-management

LEVEL Intermediate

Recommended for portfolio managers and quants who wish to construct their portfolio quantitatively, generate returns and manage risks effectively. In this course, you will learn different portfolio management techniques such as Factor Investing, Risk Parity and Kelly Portfolio, and Modern Portfolio Theory.

LIVE TRADING

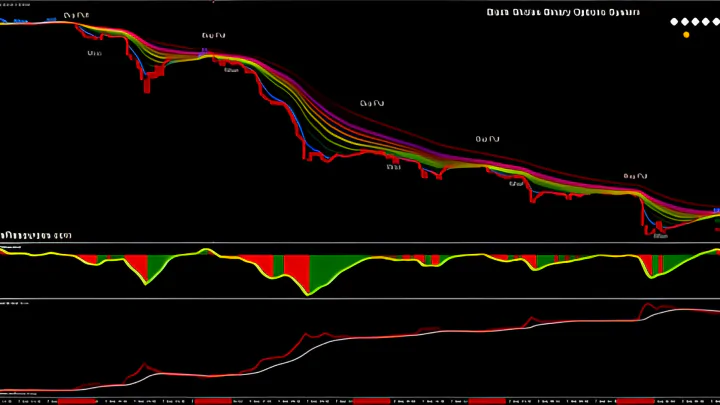

Code and backtest multi-factor portfolio strategy.

Calculate the expected returns of an asset.

Allocate capital using Kelly criterion, modern portfolio theory, and risk parity.

Explain the CAPM and the Fama-french framework.

Define different factors such as momentum, value, size and quality.

Evaluate portfolio performance using Sharpe ratio, maximum drawdown and monthly performance.

Paper trade and analyze the strategies and apply in live markets without any installations or downloads

100% Secure

Job is done or money back

- You pay only the listed price without any hidden costs.

- We keep your money until you are happy with the delivered work.

- The job will be done or your money will be returned.

Related Topics

Views: 175